The Personal Loans copyright Statements

The Personal Loans copyright Statements

Blog Article

How Personal Loans copyright can Save You Time, Stress, and Money.

Table of ContentsPersonal Loans copyright - An OverviewThe Greatest Guide To Personal Loans copyrightNot known Factual Statements About Personal Loans copyright Some Known Details About Personal Loans copyright Not known Details About Personal Loans copyright

Doing a regular spending plan will offer you the confidence you require to manage your cash efficiently. Good points come to those that wait.But conserving up for the huge points means you're not going right into financial debt for them. And you aren't paying more over time due to all that passion. Depend on us, you'll take pleasure in that family cruise or play ground collection for the kids way a lot more knowing it's currently paid for (instead of paying on them until they're off to university).

Nothing beats peace of mind (without financial debt of program)! You don't have to turn to personal finances and financial debt when points get tight. You can be free of financial debt and begin making real grip with your cash.

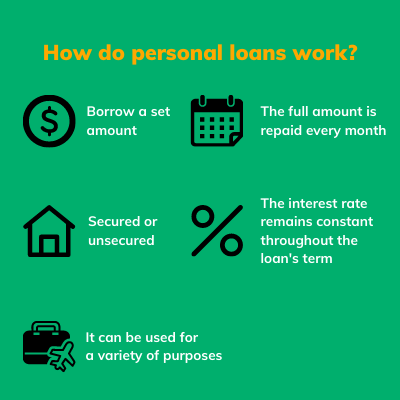

They can be protected (where you provide security) or unsecured. At Springtime Financial, you can be approved to obtain cash up to funding quantities of $35,000. An individual finance is not a credit line, as in, it is not rotating financing (Personal Loans copyright). When you're authorized for an individual finance, your lending institution gives you the sum total at one time and after that, generally, within a month, you start payment.

Everything about Personal Loans copyright

An usual factor is to combine and combine financial debt and pay every one of them off simultaneously with an individual financing. Some financial institutions put stipulations on what you can make use of the funds for, however lots of do not (they'll still ask on the application). home renovation lendings and renovation financings, car loans for relocating costs, trip finances, wedding financings, medical financings, automobile repair financings, financings for lease, tiny car lendings, funeral car loans, or other costs repayments in basic.

The need for individual car loans is rising among Canadians interested in running away the cycle of cash advance finances, consolidating their financial debt, and rebuilding their credit rating. If you're using for an individual financing, below are some things you must keep in mind.

Our Personal Loans copyright Statements

Furthermore, you may be able to lower just how much overall rate of interest you pay, which indicates even more cash can be saved. Personal finances are powerful devices for building up your credit rating score. Repayment background accounts for 35% of your credit report, so the longer you make routine repayments on time the more you will certainly see your rating rise.

Individual finances provide an excellent possibility for you to reconstruct your credit report and pay off site financial debt, however if you don't budget plan appropriately, you could dig on your own into an even much deeper opening. Missing out on one of your monthly repayments can have an adverse effect on your credit history however missing out on numerous can be ruining.

Be prepared to make each and every single payment in a timely manner. It holds true that an individual loan can be utilized for anything and it's simpler to obtain accepted than it ever before was in the past. If you don't have an immediate requirement the additional money, it may not be the best option for you.

The dealt with month-to-month payment amount on a personal loan relies on just how much you're borrowing, the rates of interest, and the fixed term. Personal Loans copyright. Your rate of interest will depend on factors like your credit history and earnings. Many times, personal financing prices are a lot less than bank card, yet occasionally they can be greater

The Only Guide to Personal Loans copyright

Advantages consist of terrific passion rates, unbelievably quick processing and financing times & the anonymity you may want. Not everyone suches as walking into a financial institution to ask for money, so if click this this is a challenging spot for you, or you just don't have time, looking at on-line lending institutions like Springtime is an excellent choice.

That mainly depends upon your click site ability to settle the amount & advantages and disadvantages exist for both. Repayment lengths for personal car loans generally fall within 9, 12, 24, 36, 48, or 60 months. Sometimes longer payment periods are an alternative, though uncommon. Shorter repayment times have really high monthly settlements however then it mores than swiftly and you don't shed more money to rate of interest.

6 Easy Facts About Personal Loans copyright Described

Your rate of interest can be tied to your repayment period as well. You could obtain a reduced rates of interest if you finance the lending over a shorter period. An individual term car loan features a concurred upon repayment routine and a dealt with or drifting rates of interest. With a floating rate of interest, the rate of interest quantity you pay will fluctuate month to month based on market modifications.

Report this page